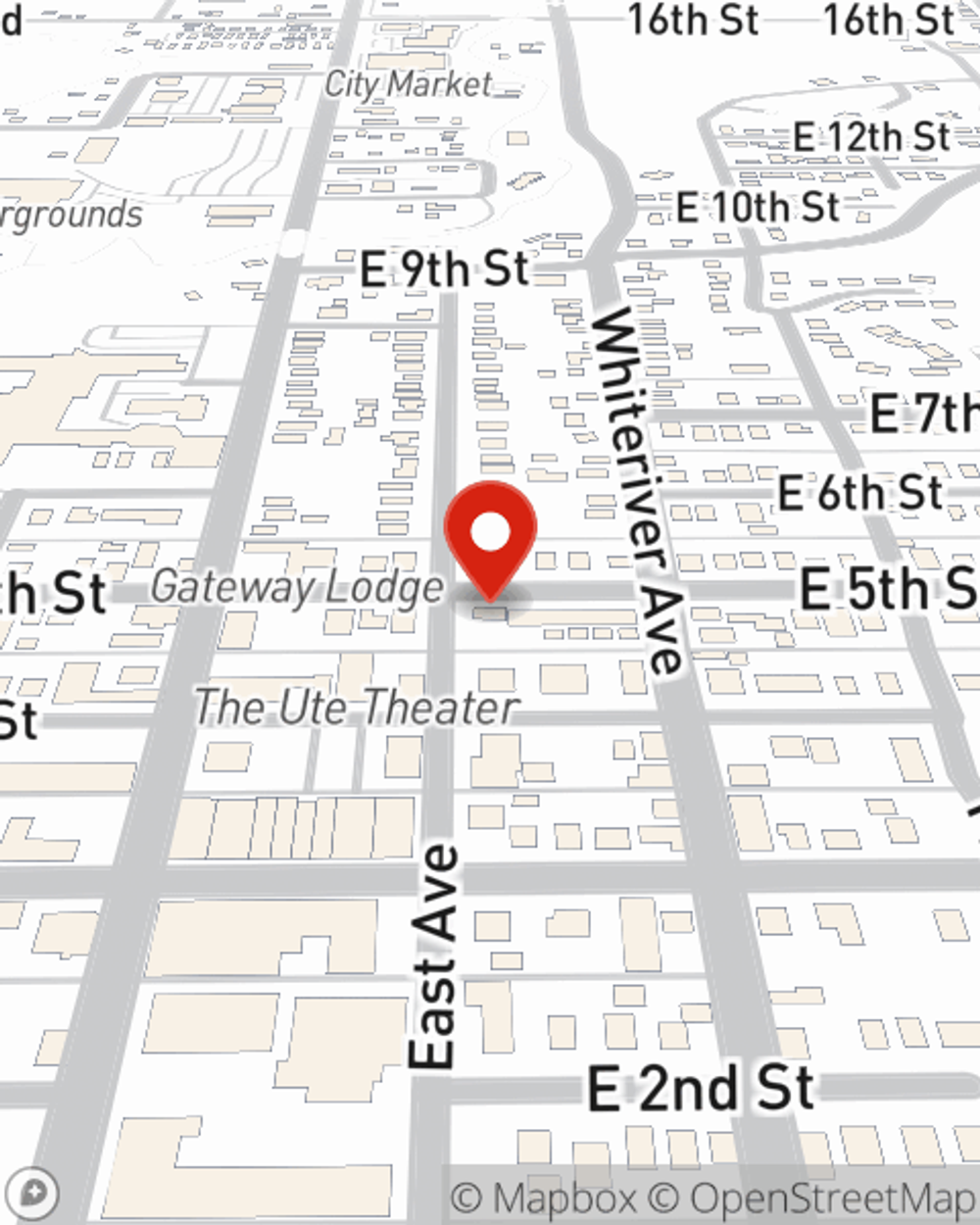

Renters Insurance in and around Rifle

Looking for renters insurance in Rifle?

Renting a home? Insure what you own.

Would you like to create a personalized renters quote?

- Silt

- Grand Junction, CO

- New Castle, CO

- Glenwood Springs, CO

- De Beque, CO

- Fruita, CO

- Meeker, CO

Calling All Rifle Renters!

There's a lot to think about when it comes to renting a home - internet access, furnishings, price, house or apartment? And on top of all that, insurance. State Farm can help you make insurance decisions easy.

Looking for renters insurance in Rifle?

Renting a home? Insure what you own.

Protect Your Home Sweet Rental Home

When the unexpected vandalism happens to your rented property or apartment, generally it affects your personal belongings, such as a smartphone, a tablet or a bicycle. That's where your renters insurance comes in. State Farm agent Jesse Dalton wants to help you evaluate your risks so that you can protect your belongings.

It's never a bad idea to make sure you're prepared. Visit State Farm agent Jesse Dalton for help understanding savings options for your rented unit.

Have More Questions About Renters Insurance?

Call Jesse at (970) 665-9770 or visit our FAQ page.

Simple Insights®

What to do after a house fire

What to do after a house fire

Consider these tips to help you and your family recover after a house fire.

What to do if you can’t pay rent

What to do if you can’t pay rent

Many people may need short-term help with rent payments. Whether due to job loss or unexpected costs, these options could help.

Jesse Dalton

State Farm® Insurance AgentSimple Insights®

What to do after a house fire

What to do after a house fire

Consider these tips to help you and your family recover after a house fire.

What to do if you can’t pay rent

What to do if you can’t pay rent

Many people may need short-term help with rent payments. Whether due to job loss or unexpected costs, these options could help.